VCL Vintners Reports January 2021 Sales Up 300% and Whisky Investors Getting Younger

let’s begin

VCL Vintners, London’s leading whisky cask broker, reports sales are up 300% year on year between January 2020 and January 2021, and new account openings up 720%. Moreover, the company also reports that whisky investors are getting younger.

According to VCL, 94% of new enquiries for the period were from investors completely new to whisky investment, and 58% viewed it through an un-emotional lens as being merely another asset class. 56% of all casks sold in the past three months at VCL Vintners were to clients in the 18-44 age demographic with 52% looking at medium term investment of 5-10 years to capture the appreciation in this most liquid of alternative assets.

“Whisky is becoming ubiquitous in private buyers’ portfolio construction and it’s encouraging that the demographic is becoming a smarter, younger City audience with longer investment horizons. We don’t view whisky investing as being an in-out asset,” said Stuart Thom, a Director at VCL Vintners.

“We’re seeing a lot of City interest at the moment from investment bankers and brokers looking to cornerstone their portfolios with whisky for the capital appreciation that shows no signs of slowing. With the markets going sideways for now and a tech bubble being rumoured in the States, whisky is being seen more and more as a stable long-term investment. Plus, there’s the pure interest factor – clients get immersed in whisky and although the research shows they’re not emotional when they start, these investments quickly become ones that people truly love over time.”

VCL Vintners is doing brisk trade in casks starting from £5,000 but predominantly in the £10-£30,000 range. For the finest and rarest whiskies, sales in 2020 saw casks changing hands for figures up to £1.2m, and this year the company is set to achieve the highest price ever at auction for a cask.

“The demand is strong across the price range of casks we sell,” says Thom, “on the buy-side there’s always demand from America and Japan and increasingly Chinese buyers are appearing in the market. The issue is supply, and at VCL we only sell casks that we actually own.”

To be classified as Scotch Whisky, casks must be held under bond in Scotland and as a result are exempt from VAT. Casks are usually brokered on whilst still in bond so VAT is not applicable. For UK tax payers, Capital Gains Tax is also not regarded as being applicable as cask whisky is viewed as a ‘wasting chattel’ due to the ‘angel’s share’ or evaporation.

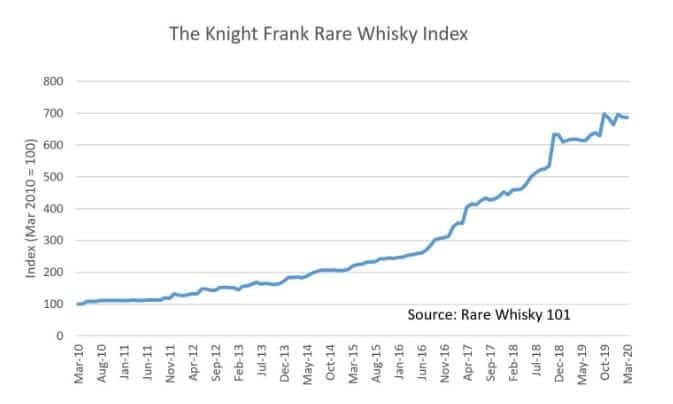

The whisky market has seen explosive appreciation in the past decade. The Knight Frank Luxury index has whisky as the top performing real alternative asset outstripping coloured diamonds, wine, art, watches and stamps to record a 586% appreciation.

“Year on year, we are seeing casks appreciate by anything from 20% to 40%,” says Thom, “And there’s just no sign of it stopping. Our clients are getting younger, put off by cash saving rates at the banks and unsure with stocks, shares or digital coins. It’s a strategy that is proving more and more popular and it’s now easier than ever to access the market.”

Greg

You might be interested in

More from the blog

Follow greatdrams

latest articles

Latest whisky

exclusively from GreatDrams

-

Japan Exclusive 10 Year Old Peated Blended Malt

£75.00Original price was: £75.00.£65.00Current price is: £65.00. -

GreatDrams Whisky Chocolates

£7.00 – £32.00 -

Linkwood 8 Year Old Single Cask Single Malt

£30.00 – £55.00