Spotlight on the Whisky Auction Market, May 2017

It is time to bring us all on the same page about the current state of the secondary whisky market. While the market as a whole continues to grow and prosper, we observed some significant changes in its composition over the last couple of months.

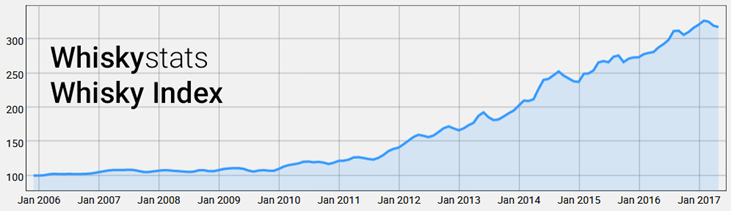

We start-off this market update with some bare figures: 2011: +18,9%. 2012: +15,6%. 2013: +24,9%. 2014: +14,4%. 2015: +15,8%. 2016: +16,8%. What these figures describe is the annual increase in value of the most traded scotch and japanese single malt whiskies. These are the numbers which cause the whisky auction market to continuously appear in the mainstream media. These are the numbers which raised the attention for whisky as an alternative investment. And finally, these are the numbers which cause the prices on the primary market to keep on climbing too.

The above figures come from the Whiskystats Whisky Index (https://www.whiskystats.net/wwi/) which describes the value development of the 300 most traded single malt whiskies on the market. Summed up they say that the price-tag of these whiskies climbed by 167% since January 2011. Although just recently in March and April this index dropped by 3,5%, at the moment we see no real reason why this growth should not be repeated in the year of 2017.

So it seems like the general direction for the whisky market as a whole is the same, but a closer look reveals some very significant changes in detail. In this article we want to point out the biggest movements of the market and refer to our Monthly Price Updates (https://www.whiskystats.net/category/monthly-update/) for more frequent whisky auction insights.

The End of the Japan Price Rally

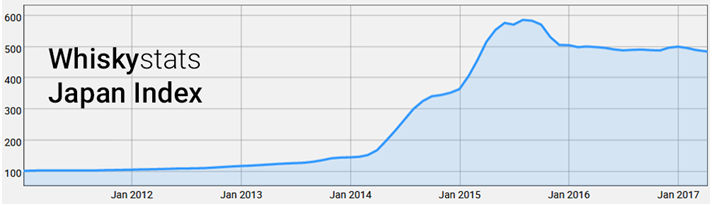

Probably no secret to any informed reader is the end of what we called the “Japanese Whisky Boom” (https://www.whiskystats.net/market-analysis/the-japanese-whisky-boom/). Over the years of 2014 and 2015 prices for japanese single malts broke through any decent price estimation with an ease. Single bottlings which once were traded for some hundred Euros were suddenly sold for a couple of thousand Euros if not more. Our Whiskystats Japan Index, which describes the value of the 100 most traded japanese single malts, climbed by almost 350% during this period.

But during late 2015 and the year of 2016 things calmed down. In January 2016 our Japan Index stayed at around 505 index points. What followed were comparably calm up and downward movements which brought this index to 486 points in April 2017. Hence, the most traded japanese single malts lost around 3,5% in value during the year of 2016. In January 2016 we published an article with the title “What the Whisky World thinks about the Japanese Whisky Boom” (https://www.whiskystats.net/general/what-the-whisky-world-thinks-about-the-japanese-whisky-boom-2/). There we concluded that “Whiskystats’ best guess is that prices settle in at a very high but market conform level”. Now, more than one year later, this seems to be the case and we still go conform to this statement.

The Return of Macallan

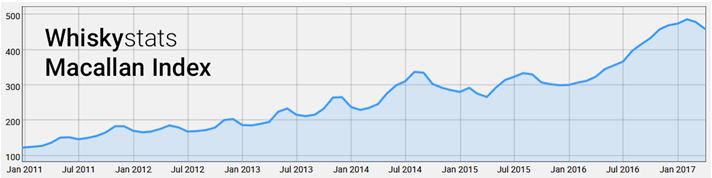

While the years of 2014 and 2015 were dominated by the japanese single malts, it was one particular scotch distillery which attracted all the attention in 2016. This distillery in question was of course secondary market favouriteMacallan. The 100 most traded Macallan bottlings gained around 60% in value from January 2016 to February 2017. Together with the end of the “Japanese Price Boom” this saw Macallan overtaking the japanese distilleries of Karuizawa and Yamazaki in our distillery ranking (https://www.whiskystats.net/distillery-ranking/). In this ranking, Macallan is currently taking the second place only behind Hanyu, another japanese distillery.

Our Macallan index reached its peak in February 2017 with little less than 500 index points. The above graph also reveals that the most traded Macallan bottlings lost value in March and April 2017. The month of March saw the index fall by 1,5%. In April the decline was more than 4%. This is why for us it seems like the apparent 2016 Macallan Price Rally came to a hault and we wonder how and if it will continue in the upcoming couple of months.

The Collector´s Classics

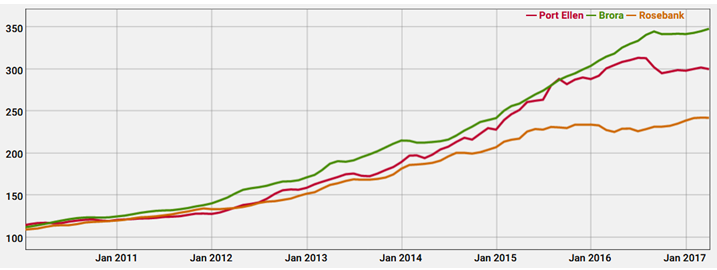

We now turn our attention to some classic and already silent scotch whisky distilleries. Traditionally, the fact that these distilleries did produce high quality single malts but are not in production anymore set prices on a very high level and brought them on the wish list of many collectors. The most famous example of this breed is of course Port Ellen. Bottlings of this once Islay-based distillery always belonged to the most sought after pieces on the secondary whisky market. The other two distilleries which we want to focus on are Brora and Rosebank. What all of these distilleries have in common is a very constant index growth all the way back to the year of 2010. This means, that the respective most traded whiskies constantly gained value.

If we look at the more recent trades of Port Ellen and Brora, it seems like prices stabilized since around the mid of 2016. In the case of Port Ellen the price-level even dropped by around 5%. For Rosebank, this price stabilization already happened in the mid of 2015. Since then, our Rosebank Index stayed at a level of around 230 points and only just recently moved up to 240. Overall we get the impression that the ever-increasing prices of these very rare and collectable single malts reached a point at which they got too expensive for the broad mass of bidders. We don’t expect the prices to fall, but a similar constant growth like we observed over the past six years or so would surprise us too. We think that the focus could once again shift to other parts of the whisky market. Two candidates for these are the distilleries of Ardbeg and Bunnahabhain.

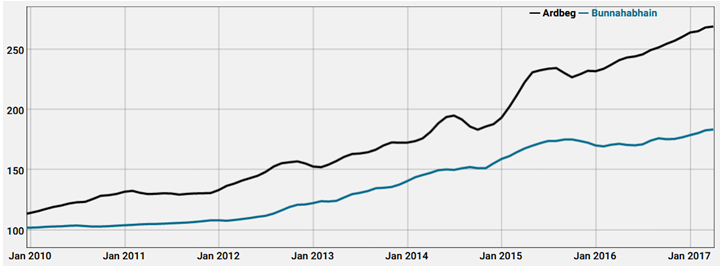

These two distilleries are of course no insider tip but very established and much traded on auction market. But a closer look at their indices shows a very solid growth in 2016. The most traded Bunnahabhain whiskies gained around 10% in value. In the same time our Ardbeg index grew by almost 18%. What both these distilleries also have in common is a comparable constant non-volatile growth over the past couple of years.

The secondary whisky market is vivid and ever-changing. It adds another facet to the single malt fascination and Whiskystats.net is here to keep you updated on the latest movements and trends.